Last September, the Taskforce on Nature-related Financial Disclosures (TNFD) published its Final Recommendations. The resulting TNFD framework (often referred to simply as “TNFD”) is a voluntary approach to reporting that businesses and financial institutions can use to shape their disclosure of nature-related risks and impacts arising from their work. Its goal is to drive “consistent and comparable reporting”, promoting action on and investment into nature protection and recovery.

While the need for action to reduce our impact on nature is urgent, businesses have tended to prioritise climate-related reporting, not least because climate metrics and targets are viewed as more straightforward to implement. According to a recent report, the number of companies disclosing climate data in 2022 through CDP (the charity that runs the global disclosure system for organisations to manage their environmental impacts, formerly ‘the Carbon Disclosure Project’) was more than double the number disclosing biodiversity data (18,600 vs 7,700).

However, businesses and financial institutions are beginning to recognise the opportunities associated with investing in nature; a World Economic Forum report identified that the 15 transitions it considered necessary to begin reversing nature loss could deliver $10 trillion of annual business opportunities by 2030, and the investment community is now discussing whether nature should be valued as its own asset class. Some UK businesses, such as South Western Railway, are pledging to become “nature positive”, committing to halt and reverse impacts on nature, in parallel to “net zero” emissions targets. So, will the launch of the TNFD bring about further action and investment in nature recovery?

Second nature

TNFD is a mirror of the Taskforce on Climate-related Financial Disclosures (TCFD), a well-established reporting framework for climate disclosures. To date, TCFD recommendations have been supported by over 3,800 companies worldwide, and several governments have enacted legislation to make reporting in line with TCFD recommendations compulsory for large businesses and financial institutions.

The TNFD’s Recommendations are broadly consistent with the wording and structure with TCFD, using the same four pillars: governance, strategy, risk, and metrics & targets. This consistency should make the TNFD easier to adopt for businesses that are already reporting in line with TCFD recommendations, and may highlight where synergistic relationships between nature and climate mean that the adoption of certain actions may benefit both.

However, TNFD includes several categories of disclosure beyond those in TCFD, which reflect nature-specific issues. These include:

- Indigenous peoples – acknowledging the critical role of indigenous communities as guardians of nature, and reducing the risk that ill-conceived offsetting/biodiversity net gain-related projects may remove land from them.

- Ecologically sensitive locations – acknowledging that nature-related issues are often highly localised; and

- Accounting for upstream and downstream impacts/risks as well as those from direct operations – acknowledging that the majority of the impacts that large businesses have on nature will be indirect, through supply chains.

TNFD has also issued additional biome-specific guidance, which maps sectors and business activities to biomes and the ecosystem services they provide, and gives examples of biome-specific impacts, dependencies, risks and opportunities and assessment metrics.

Benefits check

The TNFD Recommendations have the key benefit of making it harder for businesses to dismiss reporting on nature because it is “too complicated”.

For initial baseline measurement, the TNFD sets out a “LEAP” (Locate, Evaluate, Assess, Prepare) process for assessment and provides detailed guidance on each step, which is intended to be widely applicable. This will allow businesses to begin to assess their nature-related impacts, even if not obligated to disclose them, giving them a basis on which to make strategic decisions.

Compared with climate impacts, it can be more difficult to set nature-related targets and measure progress. The TNFD helps by providing extensive guidance on metrics and indicators, which should give businesses a better understanding of the types of data to collect and report on.

The Recommendations also create a new motivation for organisations to seriously consider their nature-related risks and impacts. It introduces a new form of regulatory risk for businesses, asset managers and other organisations, because governments may in future follow the path taken with TCFD and regulate to require TNFD reporting.

As well as being consistent with the TCFD, the Recommendations are broadly aligned with other reporting and target-setting frameworks, including the Science Based Targets for Nature initiative, the Global Reporting Initiative (GRI), and International Sustainability Standards Board (ISSB) standards S1 and S2. It is also aligned with the multilateral Kunming-Montreal Global Biodiversity Framework (GBF). The Recommendations contain a methodology to help implement Target 15 of the GBF,

“Businesses assess and disclose biodiversity dependencies, impacts and risks, and reduce negative impacts.”

This consistency of standards is essential to reassure businesses that reporting in line with one framework or standard will not conflict with other sustainability reporting and disclosure. It also helps to lend credibility to the TNFD Recommendations, which should drive further uptake and increased consistency in reporting. This will help stakeholders compare organisations and hold them to account where they are falling behind on their nature-related targets or are greenwashing.

Full disclosure?

Despite these benefits, TNFD-aligned reporting is a mammoth task for businesses with complex global supply chains. Measurement and reporting will be costly, involving the upskilling of internal staff or the hiring of external nature specialists, as well as the creation of novel internal data collection and reporting processes. It will also require significant supply chain engagement, particularly as the Recommendations specifically require reporting on “upstream and downstream impacts and risks”. Consequently, there are concerns that the complexity and cost of undertaking a TNFD assessment and making nature-related disclosures will present a significant barrier to adoption.

Conversely, TNFD is insufficient as a standalone measure to bring about the transformation necessary to reverse and halt nature degradation. Among other things, this transformation would require regulation to incentivise the diversion of finance away from harmful activities, for example agrochemical subsidies, and into activities that benefit nature, such as regenerative agriculture. Without such incentives, businesses may be unable to justify significant spend on measurement, reporting and intervention for nature recovery to stakeholders.

Natural uncertainty

There is significant uncertainty surrounding the nature reporting landscape, which may deter organisations from beginning the costly exercise of measuring and reporting on nature-related issues.

- Governments are yet to commit to following the approach taken to TCFD by making TNFD-aligned reporting mandatory for large organisations, or to give a clear indication of when they might do so;

- The markets for carbon credits, biodiversity credits and nutrient neutrality are not yet underpinned or regulated by government regulation, which would lend them credibility and reduce risk;

- The term “nature positive” lacks a precise definition, and it is unclear what role TNFD will play in driving the transition to a “nature positive world”; and

- Interventions to increase biodiversity have more unpredictable outcomes than decarbonisation interventions, making it hard to ensure that nature-related targets are achievable.

Aspects of the Recommendations themselves are open to interpretation, which may limit consistency in reporting. For example, the process by which organisations decide which nature-related issues are “material”, and therefore should be reported on, is fairly subjective. Organisations could “cherry-pick” which issues they report on, although this criticism has also been levied at TCFD and other frameworks.

Finally, but not insignificantly, there is an ethical question about whether we should be trying to fit nature into existing capitalist structures at all. Commentators, including deep ecologists and many indigenous groups, would argue that, by making ecosystems fungible, we fail to recognise their uniqueness and ignore nature’s inherent value, regardless of the services that it provides to humans. This argument, whilst not often paid much heed in business circles, raises doubts about the legitimacy of “putting a value on nature”, extending to reporting frameworks that discuss nature degradation in terms of its “financial materiality” and the risks it presents to a profit-making entity.

Call of nature

Despite these limitations, TNFD is already increasing awareness of the importance of considering nature-related impacts and dependencies. As more businesses begin to measure and report in line with the Recommendations, conversations about a nature-positive future are likely to get louder. However, to drive adoption, governments should make reporting mandatory for larger organisations – alongside introducing broader policies to incentivise nature recovery. Unfortunately, governments appear disinclined to enact such legislation, especially where it might be controversial with influential economic actors, such as agrochemical companies.

Fortunately, the reticence of some businesses may be offset by the pioneering spirit of others; GSK was the first to announce that will produce TNFD-aligned reporting (by 2026), and 320 companies have now committed to follow suit. Widespread adoption of TNFD disclosures will make it easier for governments to regulate to require other businesses to do so.

It is therefore a sensible precaution for businesses to begin applying the TNFD LEAP process to assess their current baseline for nature-related impacts and dependencies, as this will help reduce regulatory risk – as well as giving them early opportunities to find the many opportunities available to nature-positive businesses.

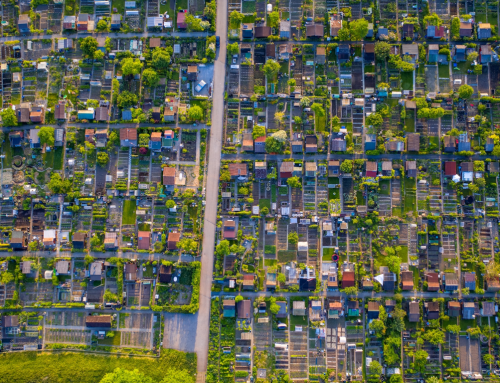

Featured image: Luca Bravo via Unsplash

Leave A Comment