by Joe Papineschi and Peter Jones

7 minute read

Local authority budgets are slimmer than ever, making it imperative for councils that separately collect materials to achieve the best possible value from them. However, while councils are experienced purchasers of goods and services, selling isn’t something they have much call to do.

Although well-versed in procurement law, some councils are unclear on the rules around selling materials. Some may not know what price it is reasonable to expect to receive. But most of all, councils may be paying too much for certainty on price.

A sale with doubts?

Let’s begin by getting the rules clear. Procurement teams take great care to ensure that council purchasing processes comply with European procurement requirements – the latest version of which have recently been transposed into law in all parts of the UK. So familiar are these rules that there is a common perception within local authorities that they need to be followed when selling secondary materials.

But this is a common misperception. The Regulations concern the purchase of goods, services or supplies by public bodies; the sale of goods or assets, such as recyclable materials, is not covered. Although councils are always obliged to follow good practice and seek best value, they don’t have to follow the OJEU process when selling recycling.

WRAP has had legal advice on this point since 2003, and the fundamentals of procurement law haven’t changed. Recent Eunomia projects for WRAP, including our 2014 guidance on material sales, have confirmed this interpretation. Still, local authority procurement teams can remain hesitant, with some concerned that the sale of recyclate may in practice involve buying a service, or should follow OJEU rules to be on the safe side. However, a “belt and braces” approach, with high transaction costs for both sides, is unlikely to yield the best price.

The price is right

A lack of experience with the material sales process can also result in authorities being unsure about what constitutes a reasonable price – especially when negotiating with buyers who trade in materials every day.

Of course, there are published market prices, and most authorities will know that they can check the latest figures on the MRW or LetsRecycle websites, or seek information from WRAP. However, it is less clear to councils whether these are the prices it is reasonable for them to expect to obtain. Although the published figures can be crude, glossing over sometimes significant variation between prices for different quality grades, they do provide a reasonable indication of real prices – although they generally understate the value of good quality separately collected material. In fact, give or take a little bit of haulage cost, published prices should be more than achievable for high quality material – at least by those with the knowledge and confidence to hold out for it.

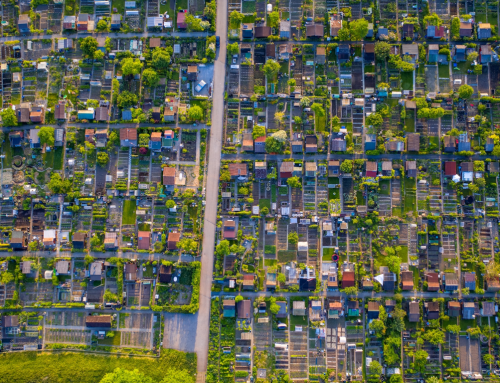

Councils may need to update their approach to material sales. Image by the Ministry of Information Photo Division Photographer, via Wikimedia Commons

For councils, though, a major concern is price volatility. There are clear, institutional reasons for waste teams to be wary of material price uncertainty, minimising the downside rather than maximising the upside. It is easy to see why: when managers are tasked with meeting fixed annual budgets, there is little incentive to undershoot (as would happen if material income exceeded expectations); but every reason to avoid the risk that lower than expected materials income could push the service over budget. In order to accept downside risk (and therefore to give the council access to the upside) the waste service needs the backing of the council as a whole, and an appreciation that – if the best overall price is to be achieved – costs will vary from year to year.

For councils that run collections and material sales in house, decision-making procedures can be time and resource-intensive, leading to a preference for longer term arrangements that reduce the frequency with which deals must be made. Indeed, if an authority cannot make sales decisions quickly (e.g. through delegating powers to officers), it may be difficult for them to enter into short term deals in a timely way.

In a fix

In-house separate collection services are now relatively few in number, while rather more have outsourced their collections – and responsibility for the sale of materials often goes along with the collection duties. Many authorities have looked for fixed material prices from their contractors, passing on all material risk. This in turn means that the contractor needs to take a view on where markets will go over the course of contract, typically of seven years or more, and price accordingly. When markets are high (as they have been in the relatively recent past), fixed prices mean that the contractor does well. However, the contractor needs to allow for times (like the present) when the market is low, and it is left bearing the cost.

With markets in an extended slump, it’s proving more difficult for councils to achieve good financial outcomes when seeking to fix material prices in contracts. It’s not just a matter of getting lower material prices – more fundamentally, trying to get the market to take more risk than it’s comfortable with can reduce competition, due to potential bidders deciding not to bid at all. This is an increasing trend, both in collection contracts and MRF contracts involving a large share of materials risk.

Like it or not, waste collection authorities – especially those operating separate collections – have been in the business of selling commodities for years: but in the past, when recycling tonnages were lower and risk more easily outsourced, this fact was easier to ignore. Now, that option is becoming less readily available, as collection contractors become less willing to accept the risk – or, at least, to do so at a reasonable price. As a result, authorities that separately collect materials need to take a more commercial view on risk.

Competition between buyers is the surest way to obtain the best value from the contract as a whole. A council that is prepared to own more of the materials risk (e.g. through accepting regular materials price reviews) will need to be prepared to accept some volatility – but this can still be limited through measures such as a floor price. However, by making the contract more attractive, a council is likely to receive a wider range of bids; and compared with a situation where only one or two companies tender, this is much more likely to result in a good “whole contract” price.

Going for brokerage

The challenge of improving material incomes is one that devolved nations, which have been keen to promote recycling, have recognised and begun to think about afresh in order to ensure their councils’ collection costs can be offset.

The Welsh Government’s collections blueprint steers councils towards separate collection, and the Government is well aware of the need to maximise material incomes. The Government is now responding to calls for a national waste brokerage to help local authorities find the best available deals. While Scotland has been less focused on separate collection, it too is developing a material brokerage service to give councils access to better prices on both recycling and residual waste.

Both will provide access to expertise on both the secondary materials market and the legal issues around material sales, removing the burden and possible worry from purchase minded council procurement teams. They will also mean that there will be, to some extent, central control over where material goes, which could ultimately help the devolved administrations to provide a secure stream of high quality material to support domestic reprocessors.

Guided reading

English local authorities don’t at present have that kind of support, and the first port of call for those looking to improve their income is WRAP’s Approaches to Material Sales guidance, which provides comprehensive advice on getting the best price for one’s secondary materials. It highlights important factors such as:

- Ensuring that the council has its own reliable tipping and bulking infrastructure arrangements to allow it independence in how it makes material available for collection.

- Apportioning risk through tools such as gain share mechanisms.

- Streamlining the supply chain by encouraging direct bids from reprocessors, rather than paying a margin to a broker.

Whether selling materials in house or through an outsourced contract, current market conditions make it imperative that authorities take a fresh look at their approach. It is no longer affordable or sensible to eliminate price risk; rather, authorities need to find ways to become more commercially agile to enable them to operate effectively in a tougher secondary materials market.

As we have commented about this issue in the past, it seems that the Waste Industry Yes Men from the Institutions down to the Practitioners do not want to change their thinking.

When a purveyor of services in this area takes upon itself the issues that are around at the time and they bid for work they must be fully aware that the prices of commodities will go down as well as up. The purveyors of services have had it “too good” for “too long! This is no different to those people who treat houses as an asset – “house prices can fall as well as increase!”

The innovators in Society are those that step out of the mind-sets of “we have always done this this way and so we will not change!” How archaic is this when even the Learned Institutions and their Paymasters get stuck in this molD! Just listen to the various discussions that took place over a century ago when the advent of ductile iron and later MDPE and other plastics were introduced in to the water industry! How long did it take before the water industry realised that MDPE was a very suitable option for water supply pipes? We have in the Waste Industry a parallel mind set where the practitioners of the day – Local Authorities – are reluctant to step out of their cosy and niche positions and recommend a status quo of events time and time again. If this were not so the notion that we have often paraded around the country that there need not be a gate fee for treating waste would have been accepted in 2006 and 2007 in Northern Ireland and Sccotland as well as England and Wales would have been the run of the mill already. But all we got in the defence of that issue was, “well we will have to go out to tender to verify this!” How ludicrous is this when the rewards for making the Renewable Fuels and energy from converting the residual biomass contained within Municipal Solid Waste will generate over €250-00 [£180-00] per tonne of such material.

Who is the loser here? Certainly it is as always the Public and the Bank-Rollers for the Waste Industry through Council Taxes and Covert Huge and Enormous Subsidies given out to the Purveyors of the Services. This has to stop and the Waste Industry must make amends.

And as for Local Authorities being the best at procurement issues here, the answer is phooey! They do not take any responsibility in this area passing their risks onward – or not as is the case here.

Although these are wise words I think a fundamental change is needed.

It shouldn’t be the job of local authority officers to play global commodity markets. The enterprises putting these materials into the waste stream (and who do themselves play the commodity markets when purchasing the raw materials) should have a greater (if not total) responsibility from cradle to grave. This should include financial support to LAs who act as agents to collect ‘their’ materials. This would shift the risk to where it is most appropriate to sit. It works elsewhere but in reality I can’t see the current government changing this. In the meantime (for example) the delivery of social care services and there budgets are at risk from the volatility in the commodity markets. Is that right?

Hi Paul,

There is a lot to be said for measures that might help to alleviate the problem of market volatility for local authorities. That could be through a revamped PRN system, or perhaps through some level of inter-authority co-operation. However, authorities are dealing with problems in the here and now, so Joe and I wanted to put some thoughts out there about measures that can be taken within the current system.

I would argue that it isn’t price volatility per se that puts other services at risk – authorities have done their best to minimise downside risk, but as a result they’ve undervalued their materials. If authorities were to accept more risk then, more of the time, they would be have more money to spend on other services.

Peter