How much of the local authority waste collection sector is contracted out? Who is it contracted out to? And how long before the various contracts fall due for retender?

This isn’t secret information and those familiar with the market will of course have a good general sense of its shape and structure. However, we haven’t previously had a precise picture showing the market shares of each of the major players and information on, for example, which company has the most contracts due to expire in each year. Eunomia has recently refreshed its contracts database and drawing on the collective memory of our lead technical consultants backed up by hundreds of calls to local authorities, we’ve put together the clearest picture we’ve ever had. Echoing a question asked on this blog about the waste treatment market last year, it’s time to reveal who’s the daddy of waste and recycling collection.

Tender spot

The most obvious fact regarding the waste collection ‘market’ is that more than half of authorities still provide their service without using an external contractor. While there are several different ways in which in house services are organised, for ease of reference I’ll call them all “DSOs”.

It would have surprised those who were active in the industry when compulsory competitive tendering was first introduced that so many years later a majority of services are still provided by the public sector. From today’s perspective it seems completely reasonable, and probably healthy, that different approaches continue to be taken: analysis we’ve done elsewhere shows that costs and performance under either model are often fairly similar.

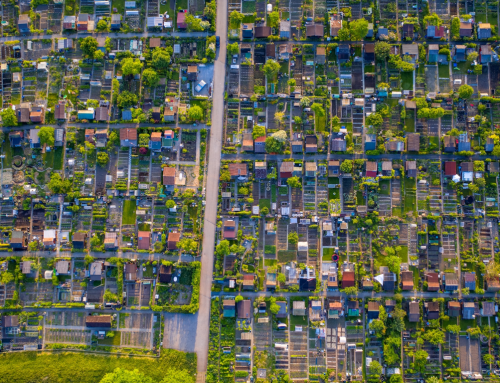

The geography of outsourcing is interesting if not surprising. In the home counties of the South East, barely a third of councils have kept their collection services in house, while in Wales only two of 22 authorities have outsourced completely. Viewed on Google maps, the data is particularly interesting, but you’ll have to take my word for that: in order to show you what I mean, I’d have to pay Google for the privilege.

Whilst there’s a bit of a political pattern, to match the geographical pattern, it’s not overwhelming. Plenty of Labour authorities have their services operated by contractors whilst a similar number of Conservative authorities are resolute in their support of a DSO (or similar in-house) model.

For the moment, there are no clear trends in the direction of one model or the other. A trickle of authorities that have run DSOs in the past have recently outsourced, whilst others, that have had a contractor in for many years are bringing their services back in-house.

Moving picture

For the part of the market where services are outsourced, it’s interesting to have a clear picture of which companies have grabbed the largest share.

The sheer number of competitors in the market is surprising. The chart above groups ‘Others’ into one bar for the sake of presentation, but in total 23 companies operate at least one service.

Clearly Veolia is streets ahead of the rest with 40 contracts, while Biffa their closest rivals have just over 30. Behind these long-established players are relative upstarts: the developing merger between Kier and May Gurney turns these two medium-sized players into the third largest holder of local authority contracts, leapfrogging Serco and Amey Cespa.

Return to tender

Things are likely to continue to change as contracts expire and are re-tendered. Next year will be relatively stable with only a handful of contracts being let. But in 2015 and 2016 there will be far larger numbers of authorities whose contracts are up. Although many of those will be re-awarded to the incumbent, or extended, there’s an outside possibility that as many as 35 contracts will change hands. If more DSOs outsource and no authorities insource, the number could be even higher.

Not only will many contracts change hands through normal re-tendering, the identities of the main players are also likely change. Local authorities are seeing their budgets diminish dramatically year on year, and are likely to be looking harder than ever for savings on waste collection. There’s already been some consolidation in the market and, with material prices low and collection companies under pressure, I’d expect to see the waste collection map of the future look very different.

Companies should revert to allow totters to return to sites. Saving winning contract bidders would save on labour costs and will adhere to relevant rules and regs. They can shift more of what is reusable than most big players, this has to be the way forward as there are no incentives for a paid employee of a big company.