by Dominic Hogg

7 minute read

There’s a hackneyed phrase that people often come out with when they are looking for improved data: ‘you can’t manage what you can’t measure’. Waste management strikes me as the perfect counter example: for anything other than waste collected by local authorities, the quality of the UK’s waste data is generally of terrible quality. Does that really mean we don’t know a thing about how waste should be managed?

Clearly not: we can, and do, manage waste. If we had waited to measure everything before we started to manage waste more actively, there still wouldn’t be much other than disposal happening with some waste streams today. However, this isn’t to say that data isn’t useful. If we knew more, and had better information, then we’d be in better shape to invest in the management of waste and to prevent it being generated in the first place. Unfortunately, the data does remain pretty poor. And it’s misleading, which becomes increasingly problematic as you try to make finer-grained policy decisions off the back of it.

Blind data

In 2011 I had the dubious pleasure of trying to update the ‘activity data’ in the model the UK uses to report its landfill methane emissions to the UN Framework Convention on Climate Change. The landfill tonnage figures were obviously out of date at the time; so, I set about correcting them.

One of the biggest headaches was trying to make sense of the difference between the two sets of data being used: one from the Environment Agency’s site returns and the other from HMRC, based on landfill tax returns. The two seemed to be telling such different stories that I wondered whether anyone had previously attempted to reconcile them.

This was of more than academic interest, since although there was probably better knowledge about the wastes being reported by HMRC, from the perspective of landfill emissions, if the site Environment Agency return data included information on wastes capable of generating methane then they should have be included in the model.

I recall interrogating staff from the Environment Agency, SEPA and HMRC over how I could get to the bottom of the difference in the reported figures – how was it that so much more waste was being reported as landfilled under the site returns data than by HMRC? I recall being given a number of reasons, two of them being:

- that some landfill sites are not registered with HMRC – i.e. those which only accept wastes not attracting tax; and

- that the site returns data often included waste reported at a site which might not only include a landfill but also other facilities besides – i.e. some waste reported as received by the site would not actually be landfilled.

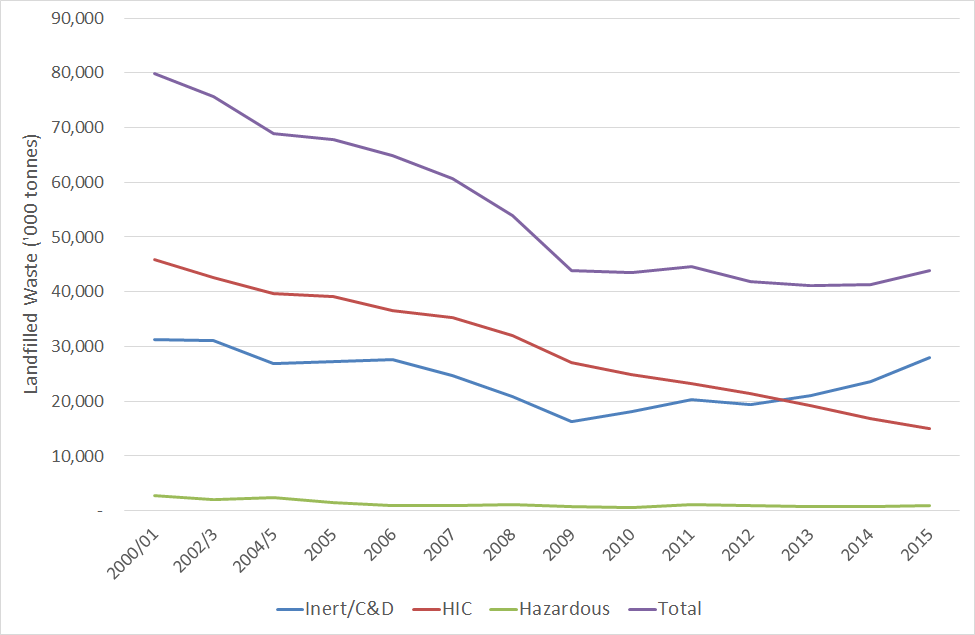

So it was with interest that I read in MRW about the Environment Agency data indicating that 43.9 million tonnes of waste was landfilled in England in 2015. MRW also reported that the pace at which landfilling was deceasing was slowing, and indeed had reversed in the most recent year. In fact, according to the Agency, the amount of waste landfilled had barely changed since 2009.

Surely this couldn’t be right?

Second data

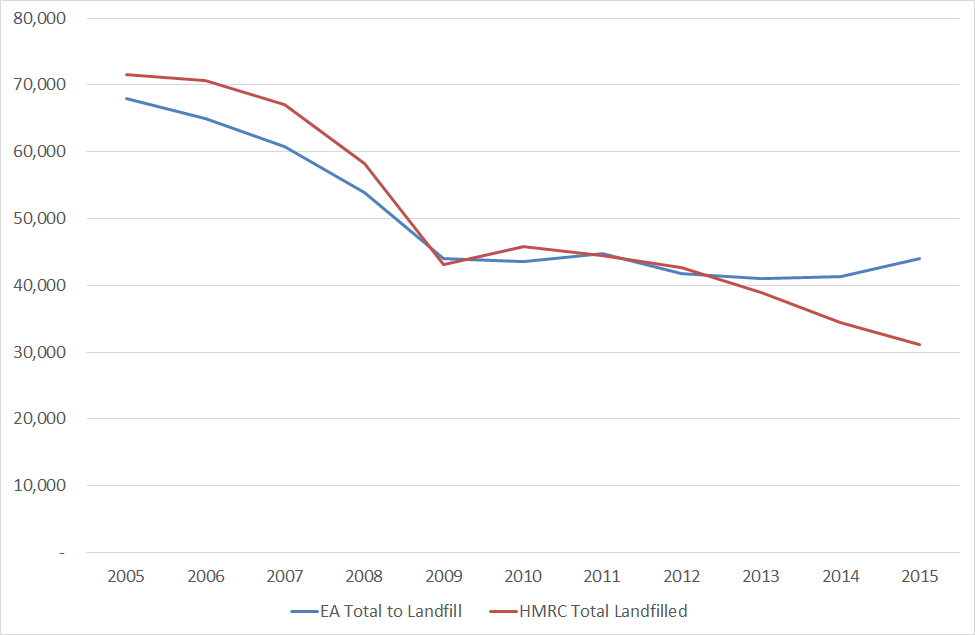

I was immediately rummaging for the comparable HMRC figures based on landfill tax receipts. There was a palpable feeling of déjà vu when I looked at the figures, which indicated that since 2009, including waste exempt from tax, waste landfilled in the whole of the UK had fallen from 43 million tonnes to 31 million tonnes.

Until 2012, the Environment Agency figures track the HMRC data reasonably but over the last few years, they have parted company. Now the Environment Agency reports 13 million tonnes or so more waste being landfilled than does HMRC. Who would claim to know what had happened to the all of this waste, which HMRC simply has no record of?

Was HMRC treating landfillers, when it comes to tax, just like it treats multinationals? Or is there some obvious, clear explanation as to how and why the Environment Agency reports this waste as landfilled but HMRC chooses to ignore it?

Into this debate steps HMRC with its analysis of the landfill tax gap, helpfully reported by CIWM. HMRC seeks to understand the gap between the revenue which should be collected from the tax and the amount actually collected. This is around 12% of the total revenue take, or £0.15 billion in 2014/15, which is three times the level of the gap estimated in 2009/10. This does not account for waste being disposed at illegal sites (neither for the matter does the Environment Agency data), and so the main contributing factors are undeclared waste and wastes mis-described in respect of the appropriate rate of tax that should be applied. Of these two, only the former would have an effect on reported quantities of waste landfilled. Suffice to say, this does little to close the gap between HMRC and Environment Agency figures on waste landfilled.

What does this tell us? For one, it indicates that as the tax differential between standard and lower rates has increased, the incentive to mis-describe waste is likely to have grown, widening the tax gap. Second, the lack of meaningful attempts to reconcile such apparently divergent data tells us that there’s not much interest in obtaining quality data for the waste management sector – which everyone knew. Third, the size of the tax gap – at £150 million – is now sufficiently large that there could be plausible financial justifications for measures that may lead to a closing of the gap. This would be especially true if the measures also had some influence on the extent of illegal behaviour, recognising that this implies a further loss in tax revenue not accounted for in the tax gap analysis.

Getting on track

The irony here is that one such measure might be the implementation of a high quality, mandatory waste tracking system to be implemented across the UK, linked to electronic reporting of waste data. There are extremely good reasons to believe this would pay for itself, and looking at the HMRC figures, and based on what we know about illegal activity, the pay-back period would be very rapid indeed.

Such a system could help HMRC narrow the gap between what should be collected as tax and what actually is. Additional tax revenue might be generated from a reduction in illegal activity, and bringing waste into legal management routes would increase the value added generated by the sector for the UK economy. The key thing missing is a system for generating and reporting quality data, and for processing this quickly.

The utterly bizarre thing about the HMRC and Environment Agency data is that they can be interpreted as telling us completely different things: the former has landfilled quantities still falling (and quite rapidly), while the latter says that landfilling is not falling at all. Not to see a reduction in landfilling would be surprising, given the rise in landfill tax, continued increases in recycling over the period (notwithstanding the slowdown in England), the addition of millions of tonnes of incineration capacity, the export of waste as RDF to the continent, and other things besides.

I know which situation I think is more likely, regarding the wastes of interest to HMRC, but it really is incumbent on Defra to reconcile these datasets, or at least to highlight that they can’t be reconciled and explain why.

A version of this article first appeared in MRW.

From extensive experience of using the Agency data at local level I can confirm that significant tonnages of waste declared as going to sites with landfill permits do not necessarily get landfilled – at least immediately. Often it is subject to some pre-treatment – composting, bioremediation etc – from which some waste may not actually end up being landfilled at all. This also poses the prospect in some cases of waste going to such sites being double counted. So to me it is no surprise that the EA data indicates a greater tonnage than the HMRC data – it would be more concerning if the reverse was true. The discrepancy does not necessarily mean that either dataset is ‘wrong’. Just that they are recording different flows (albeit under apparently the same heading).

Ideally the permitting categories used would be refined to address this but with the advent of IED permittting the tendency will increase with sites upon which a range of waste related activities may take place governed under a single permit as an installation.

This is an example of where it is important people analysing Agency held data have an understanding of the regulatory context so we can act as a bridge to help lead policy makers towards genuine understanding rather than conflating discrepancies as ‘false’ problems.

I think that basically we’re mostly in agreement. A major cause of the difference is that the EA counts as ‘landfill deposits’ some material that isn’t landfilled.

However, I remain concerned about the misleading presentation of data, where what are described as ‘landfill deposits’ mean nothing of the sort. Why not rename this as ‘waste accepted at sites which are registered as landfills, but which may include other activities’? That would help avoid the risk that policy makers are misled.

The point is about the reconciliation is – how does the EA or HMRC, or any other interested party, know what is actually being landfilled? Isn’t it of some interest to know that, whether you concerned with environmental management or the collection of Landfill Tax?

And isn’t this the issue – that there APPEARS to be no reconciliation between HMRC and the Agencies? Does HMRC have a list of every operational landfill site, for instance? If the Waste Tonnage Return Form https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/519072/LIT_10459.pdf is all that is provided by operators, then I can see why there is the confusion.

Agree renaming “waste accepted at sites permitted as landfills which may not actually be destined for landfill (as other activities may be conducted on the site)” would be more accurate but does it take a whole article to make that point Dominic? My concern is that ‘hares are set running’ that dont actually exist. Surely it is our responsibiilty as experts in the field to seek to understand these before making public pronouncements?

Yes in an ideal world the figures would reconcile. There are a whole load of improvements that could be made to the categorisations used by the Agency in waste regulation some of which have direct effect on the permit holders and some of which can have profound effects on capacity assessments undertaken to support the formulation of waste plans if not fully understood. We are frequently reworking data produced by others which display only a partial understanding of the datasets.

wrt to Phil’s comment I am pretty sure HMRC have a listing of all sites with permits to landfill.

It would also be useful would be a breakdown of Landfill Tax tonnages between the different parts of the UK given that the EA’s 43.5m tonnes is for England only. I have tried to get this from HMRC but have been told it is not available…. What is extraordinary is that the EA figures were published without any reference to the LT numbers at all.