by Matt Smith and Tessa Lee

6 minute readLocal authorities in England and Wales spend around £1.6bn each year on collecting waste and recycling – over £1.4bn in England, and around £150m in Wales. Some undertake collections themselves, while others deliver their services through contractors.

However, there’s little published information on the trends in the market – how many authorities are contracting out services? What is the market share of different contractors? And who have been the winners in procurement over the last few years? Drawing on data collated by Eunomia, this article presents the latest position.

No LAC of competition

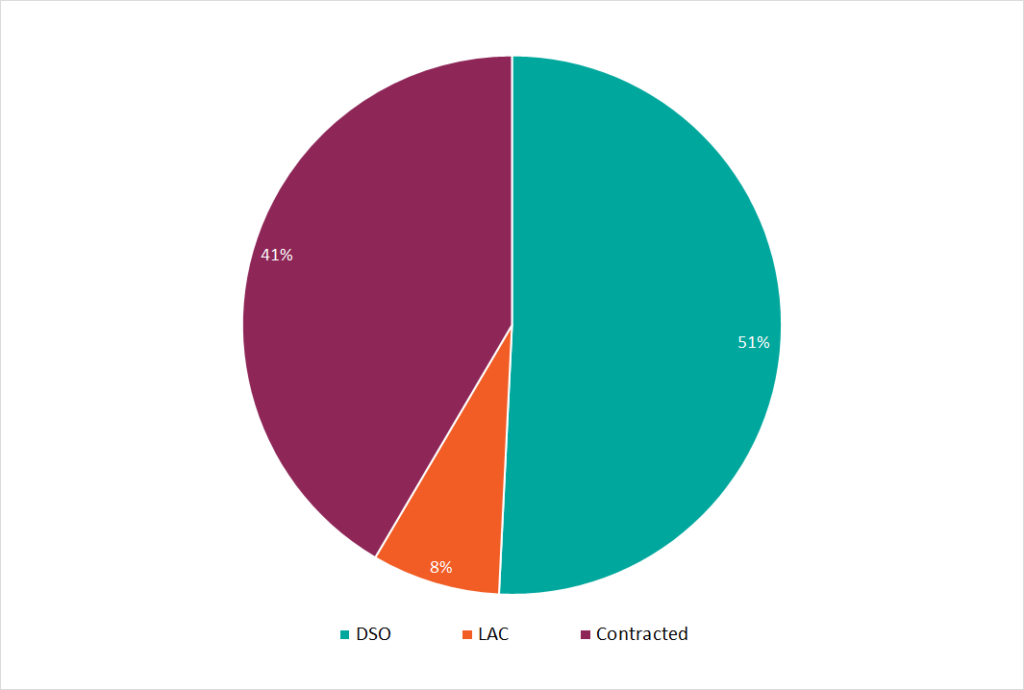

Isonomia last published Eunomia’s data back in 2013. At that point, 55% of local authorities in England and Wales were delivering collection services in-house, with private contractors responsible for the remaining 45%. Fast-forward seven years and private contractors are delivering slightly fewer – 41% – of collection services, while 51% of authorities are delivering in house. The contracted out figure includes a few cases where a contractor delivers part of the service, typically the recycling collections, while the council undertakes the remainder in house.

The remainder of collection services are now run by local authority companies (LACs), which have come to prominence as procurement law has evolved: first under the so-called “Teckal” exemption, which was then written into law in the Public Contracts Regulations 2015. As a result, authorities can now award services to companies that they own, without the need for competition.

Proportion of waste collection authorities using each delivery approach. Source: Eunomia.

A LAC allows a local authority (or often a partnership of authorities) greater control over service delivery. It eliminates the profit margin a private contractor would expect while delivering services more commercially than an in-house operation. In theory, at least, it is a happy medium between the two, although these purported benefits are contested and much depends on the management expertise a LAC is able to assemble. In 2013, there were so few LACs that it wasn’t worth separating them from in-house service. While their numbers have increased, LACs still run a small minority – 8% – of collection services.

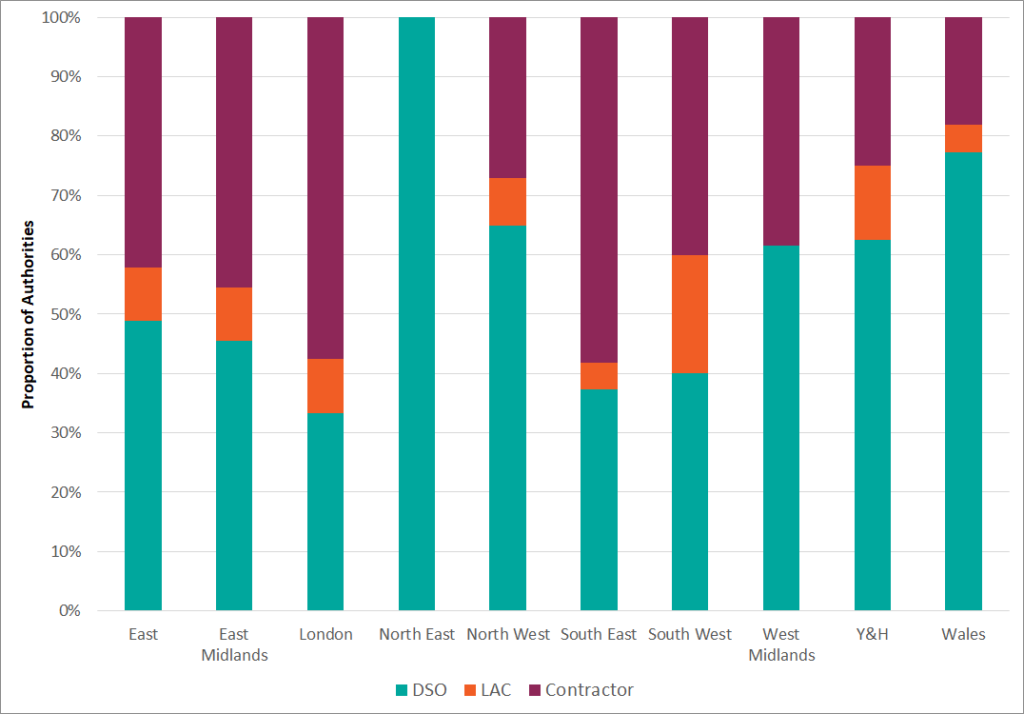

The picture varies a good deal from region to region. There are no contracted-out authorities in the North East of England, and very few in Wales. By contrast, in the South East and London, more than half of authorities contract out their collection services. The highest proportion of authorities using LACs can be found in the South West, while there are none in the West Midlands or North East.

Proportion of waste collection authorities in each English region and in Wales using each delivery approach. Source: Eunomia.

The last few years have seen numerous authorities change their arrangements – some bringing services back in-house, some outsourcing, some switching to a LAC from either of the more established approaches – but the net effect has been that the LACs have eaten into the market share of both contracted out and in house delivery.

Share portfolio

Back in 2013, 23 private companies operated at least one local authority service. That number has now fallen to 15. Through this period of consolidation, Veolia has remained the clear market leader, with contracts covering 35 collection authorities (approximately 26% of contracted out authorities). Biffa has held onto second place, with 28 contracts or a 21% market share. The company that has made the most significant gains in recent years is Urbaser: having only entered the market in 2010, they have picked up ten authorities’ contracts and now hold a 7% share of the contracted out market.

There have been considerable shifts in the waste collection and environmental services market over the last decade. Companies have sold, merged, divested, expanded and changed their service offering. Amongst the bigger players in 2013:

- Cory, which had five contracts, sold its municipal waste business to Biffa in 2016;

- May Gurney, which had 13 contracts, was bought by Kier in 2013.

Meanwhile, Kier has exited, or lost, the majority of its contracts, and one of the two that it still holds will pass to Serco in 2021 as the result of an already completed tender process. If they exit the municipal waste market, as appears likely, and with Amey not having bid for any recent contracts, the number of major players could soon be down to six.

With fewer companies in the market, there is some risk of a reduction in competition, which may lead to authorities becoming concerned about how easy it will be to secure value from contracting out a service. However, in practice, it is possible to have an effective competition with three bidders, or fewer, if the procurement process is expertly managed. Still, there is a growing onus on authorities to design their contract and procurement process to attract bidders, and ensure that the responses, and the evaluation, facilitates genuine competition.

In addition to the changing composition of the contractor base, there has been some movement in the number of contracts held by the bigger players. Between them, Veolia and Biffa hold almost half of the available contracts, but both have seen the number they hold reduce. Meanwhile, FCC, Serco, SUEZ and Urbaser have all seen growth, controlling a combined total of 39% of the market. This itself gives some comfort that the market remains competitive.

Change in number of collection authorities for which each company holds contracts (2013-2020). Source: Eunomia.

Predictive text

The changes in the market over the last few years seem unlikely to be at an end, with a substantial likelihood of further consolidation. A key question will be whether Veolia and Biffa further cement their position, or whether some of the businesses that have increased the number of contracts they hold, such as SUEZ and Urbaser, seize the opportunities. There has been a shortage of new entrants, perhaps put off by the slim margins and exposure to material price risk that has been challenging for all those delivering municipal collection services for authorities.

There is still no clear preference between in house and outsourced delivery, with roughly even numbers of authorities opting for each approach, which suggests that the economic and service delivery benefits of both are finely balanced. While LACs have been on the rise, it is by no means certain that this trend will continue, as not every local authority will feel that such an arrangement is right for them.

However, the future holds the prospect of a wave of service changes in England to deliver the government’s Resources and Waste Strategy, necessitating new food waste collections and perhaps a greater focus on source separation. There ought also to be an influx of money from Extended Producer Responsibility schemes, to drive changes that will enable the UK to meet its packaging and municipal waste recycling targets, and perhaps a shift in focus towards improving performance instead of the relentless drive to reduce costs that have characterised the austerity years.

How authorities will respond remains to be seen: some may be apprehensive about the risk of additional costs if they need to substantially alter the specification during the lifetime of a collection contract; others may feel they need the expertise a contractor can bring to support the design and implementation of major service changes. The market, too, may be affected, with new money perhaps attracting new players. Whatever else happens, it seems inevitable that the pace of change in the municipal waste market will be still faster in the years ahead.

Featured image: harrypope (CC BY-NC-ND 2.0), via Flickr.

Matt Smith and Tessa Lee

Leave A Comment